- Solana’s TVL climbed by almost 15% in the last month.

- While user activity declined during the same period, the network saw growth in transaction fees and revenue.

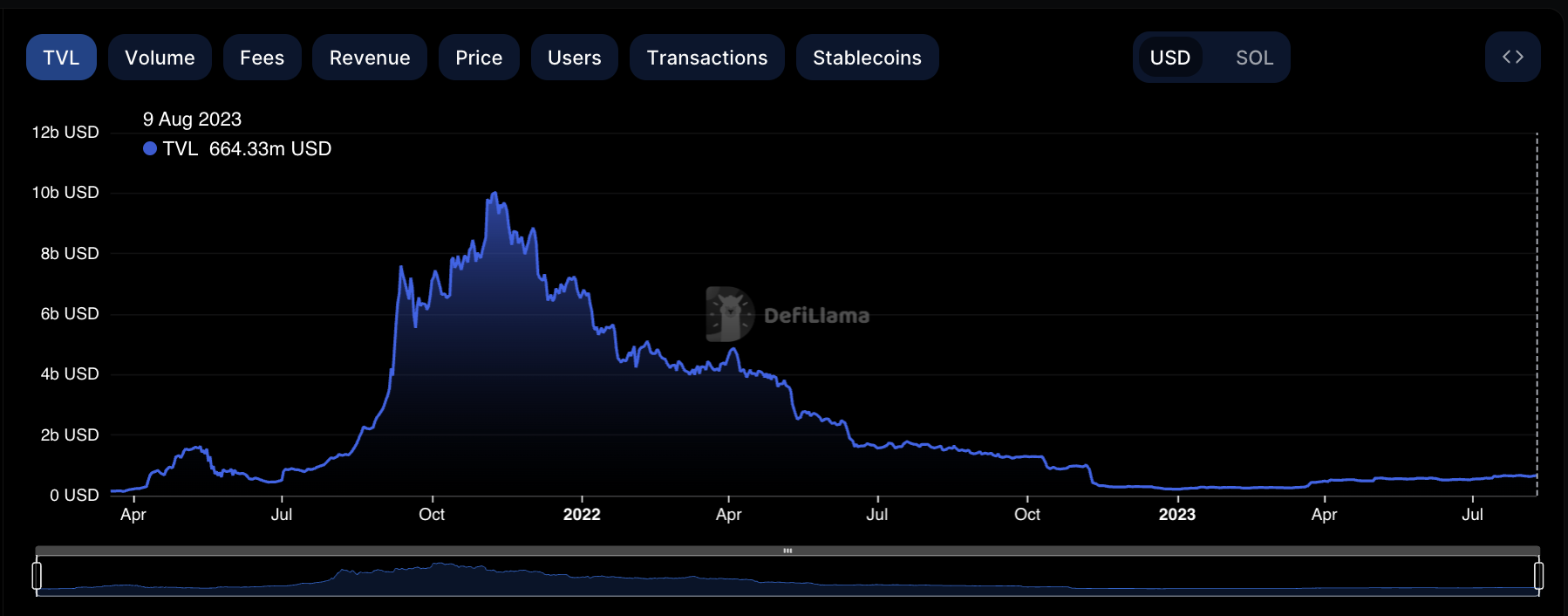

Solana registered a total value-locked (TVL) growth of 14% in the last month, while other leading chains suffered a decline, data from Messari revealed.

Solana managed to grow its TVL last month, as most major chains declined pic.twitter.com/zVwUgy7Mtp

— Messari (@MessariCrypto) August 7, 2023

While last year’s downtimes and the seven major exploits the chain experienced in 2022 led to a severe decline in its TVL, the year so far has been different. Per Messari, Solana’s TVL at the beginning of the year was $209.25 million. Growing by 217% since then, the Layer 1 (L1) network’s TVL was $664 million at press time.

As Solana registered a TVL uptick in the last month, other top L1 networks Ethereum, Binance Smart Chain, and Avalanche, saw respective declines of 13%, 6%, and 10%.

Regarding Layer 2 (L2) scaling solutions, Arbitrum saw its TVL fall by 7% in the last month. Optimism, however, fared better as the rollup network logged a 10% jump in its TVL during the same period.

State of Solana

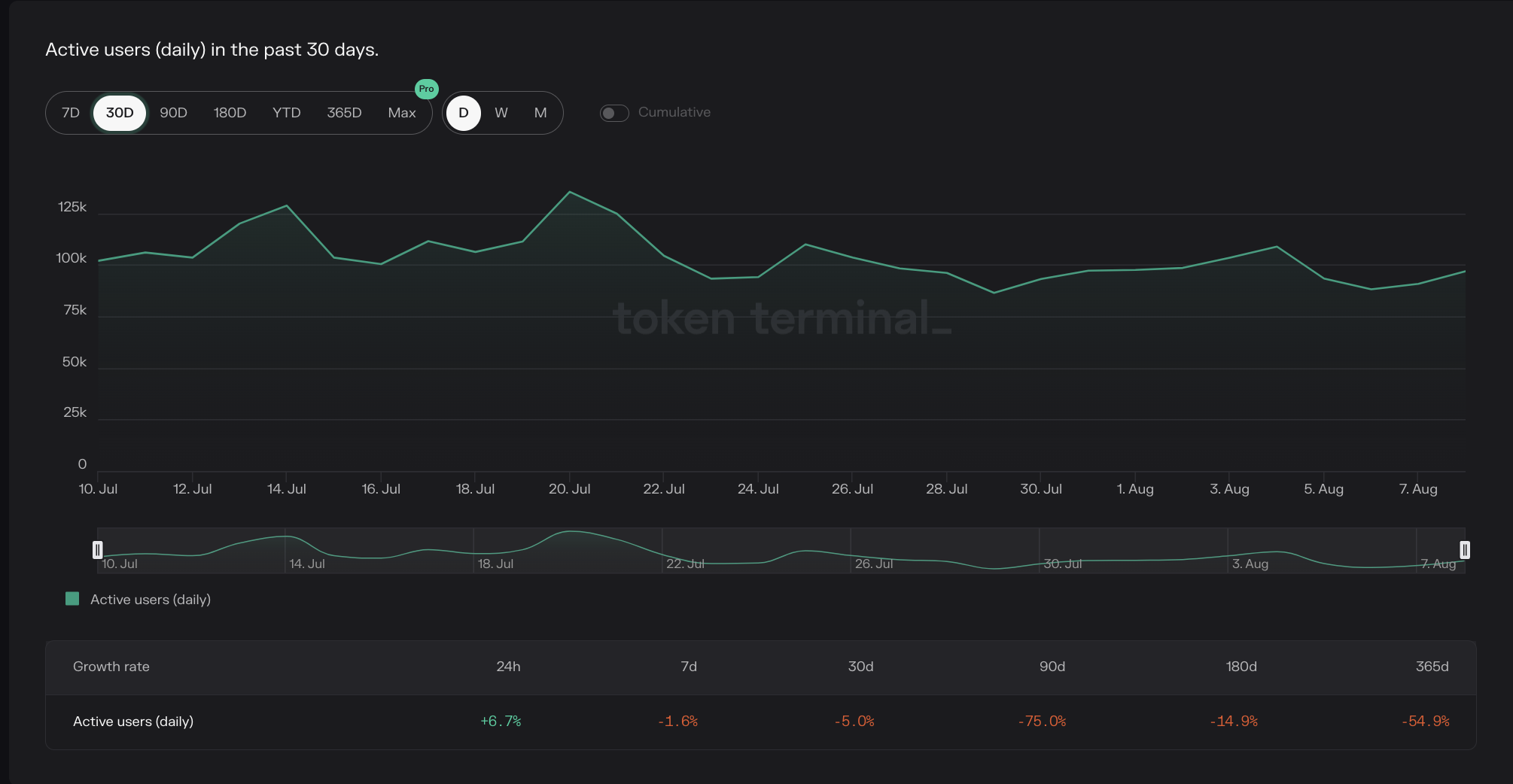

Despite registering a TVL growth in the last month, user activity on Solana suffered a shortfall. Per data from Token Terminal, the network registered a 5% decline in active user count in the past 30 days.

For context, user activity on the chain has been on a steady decline in the last year, primarily due to the several downtimes and exploits the network suffered during that period. In the past 180 days, daily active user count dropped by 15%. In the last 12 months, this fell by over 50%.

The 1.6% drop in active user activity on Solana last week reduced trading volume across the decentralized exchanges hosted on the chain. zkSync, with a much lower TVL, exceeded Solana in DEX volume during that period, on-chain data revealed.

Zk Sync did more dex volume than Solana last week and Pulse Chain did more than Avalanche pic.twitter.com/4clej4w12q

— Size Chad (@SizeChad) August 8, 2023

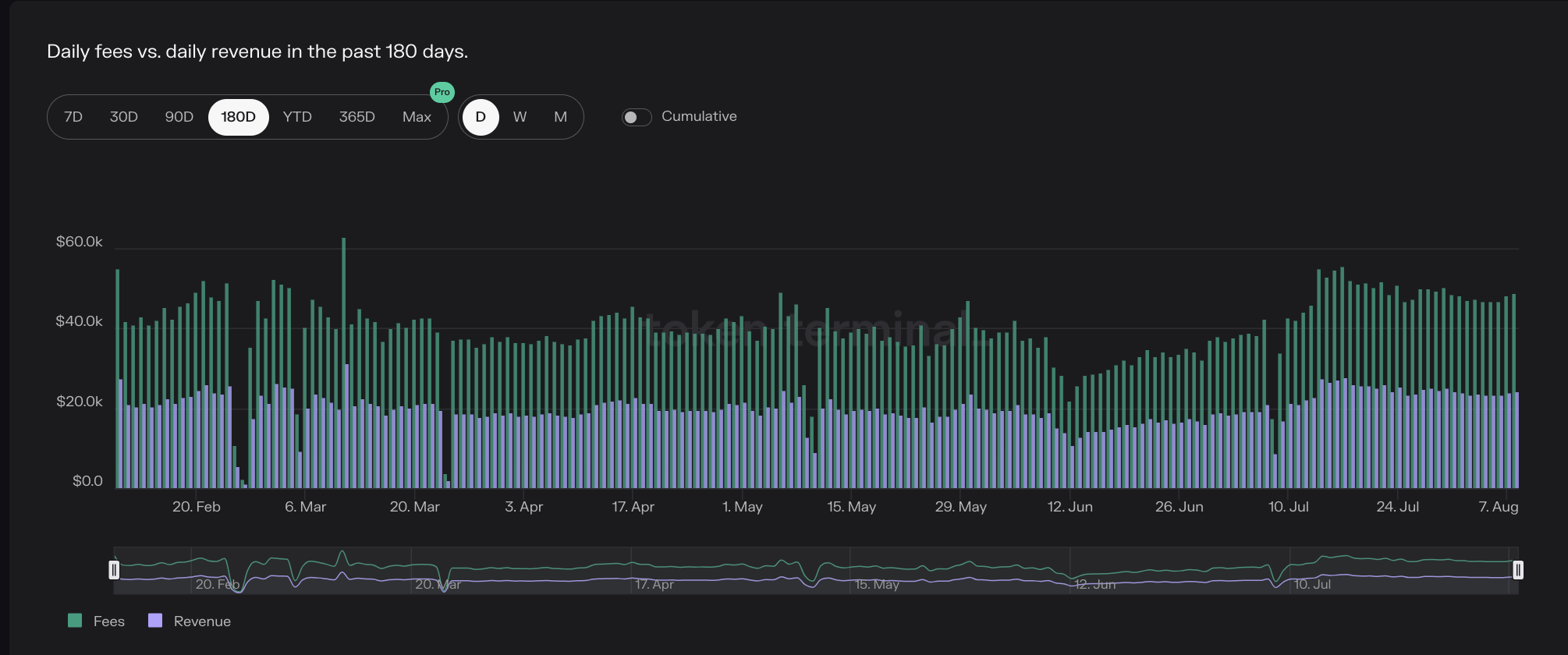

However, a silver lining exists. While user activity and trading volume suffered a decline, Solana’s transaction fees and network revenue surged. Per data from Solscan, network fees charged for successful non-vote transactions climbed to a high of 53.06 SOL on 2 August.

While it has since declined, this represented a significant growth in network fees from 31.64 SOL recorded a month ago.

A broader assessment of all network fees revealed a 50% jump in the last month. Solana also saw a corresponding hike in revenue during the same period. On an annualized basis, the L1’s revenue has gone up by 21%.