- X’s API ban erased Yaps, removing most of the real token utility of KAITO.

- Insider wallet transfers before the shutdown intensified sell pressure.

- KAITO’s price has fallen below key support, leaving the token near all-time lows.

Kaito has officially begun winding down its Yaps product after losing access to the X API, marking a major turning point for the project and its token economy.

The decision follows a recent policy change by X, formerly Twitter, which banned applications that reward users for posting content on the platform.

X cited a surge in AI-generated spam and low-quality engagement as the primary reason for revoking API access from so-called “reward-for-posting” or InfoFi apps.

Why X’s move forced Kaito to pull down Yaps

Yaps was Kaito’s flagship product and the core driver of user engagement across the ecosystem.

The program rewarded users with KAITO tokens for creating and interacting with crypto-related posts on X.

For many participants, Yaps represented the main reason to hold and use the KAITO token.

According to multiple industry estimates, Yaps accounted for roughly 70% of KAITO’s practical token utility.

Hence, the shutdown triggered an immediate and severe demand shock for the token.

Kaito confirmed that the Yaps incentive program and its associated leaderboards would be sunset rather than modified.

The company stated that the product could not operate in compliance with X’s new API restrictions.

This forced exit exposed the risks of building token-driven engagement models on centralized social platforms.

Thousands of users were affected by the move almost overnight.

Data shared by market trackers indicates that approximately 157,000 Yaps-associated accounts were banned or disabled following the policy enforcement.

The sudden loss of users accelerated selling pressure as participants exited positions tied to the discontinued program.

Market reaction and insider trading concerns

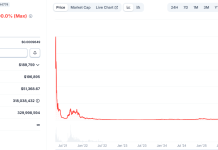

The market reaction to the Yaps shutdown was swift and decisive.

KAITO fell 19.5% in a 24-hour period, sharply underperforming the broader crypto market, which declined by just 1.05% over the same timeframe.

The token dropped to around $0.5449, sliding close to its all-time low of $0.4717 recorded in December.

Trading volume surged to over $153 million in 24 hours, representing more than the project’s daily market capitalization turnover.

This spike in volume signaled conviction-driven selling rather than a temporary volatility spike.

Sentiment deteriorated further after allegations of insider trading began circulating within the crypto community.

On-chain analysts flagged a wallet linked to the Kaito team that deposited 5 million KAITO tokens, worth roughly $2.7 million at the time, to Binance.

The transfer occurred approximately seven days before the public announcement of the Yaps shutdown.

This deposit represented nearly 2% of the circulating supply and was the largest exchange inflow for KAITO in the last 90 days.

While no wrongdoing has been proven, the timing raised concerns about information asymmetry.

Retail investors interpreted the move as a potential loss of confidence from insiders.

Trust erosion compounded the downside pressure already created by the loss of token utility.

At the same time, Kaito is attempting to reposition its business model.

The company announced a pivot toward Kaito Studio, a product focused on connecting brands with vetted creators.

Unlike Yaps, the new model emphasizes quality-driven marketing and analytics rather than mass token incentives.

This transition reduces reliance on retail participation but introduces uncertainty around KAITO’s future role.

It remains unclear whether brands will be required to use KAITO as a payment or settlement token.

Without a clearly defined demand loop, token value accrual becomes harder to justify in the near term.

KAITO price analysis and ecosystem transition

From a technical perspective, KAITO confirmed a bearish breakdown.

The price slipped below the key $0.60 support level, which had acted as both a psychological and structural floor.

Momentum indicators have turned decisively negative following the breakdown.

The MACD histogram has flipped bearish while the RSI hovered near 44, suggesting further downside remained possible.

Algorithmic trading systems also appear to accelerate selling after the $0.60 support was lost.

With limited historical support below current levels, the next major technical target sits near $0.47.

Kaito price forecast

KAITO currently trades at approximately $0.5449 with a market capitalization near $131 million and a fully diluted valuation of approximately $540 million.

The wide gap between circulating and total supply highlights ongoing dilution risk.

In the short term, price action remains fragile as long as KAITO trades below the $0.60 resistance zone.

A failure to hold above $0.50 could open the door to a retest of the $0.47 all-time low.

Any relief rallies are likely to face heavy selling pressure from trapped holders near prior support levels.

A bullish reversal would require a sustained reclaim of $0.60 accompanied by declining sell volume.

Fundamentally, clarity around insider wallet activity and transparent communication from the team are critical.

Longer-term upside depends on whether Kaito Studio can generate real demand that directly involves the KAITO token.

Until that narrative is proven, KAITO is likely to remain volatile and sentiment-driven.

For now, the market appears to be pricing in caution rather than confidence.

The post Kaito winds down Yaps product after losing access to the X API appeared first on CoinJournal.