- Breakout from a seven-year double-bottom pattern confirmed.

- 95% probability of spot ETF approval influencing sentiment.

- XRP Ledger market cap-to-TVL ratio stands at about 2,200.

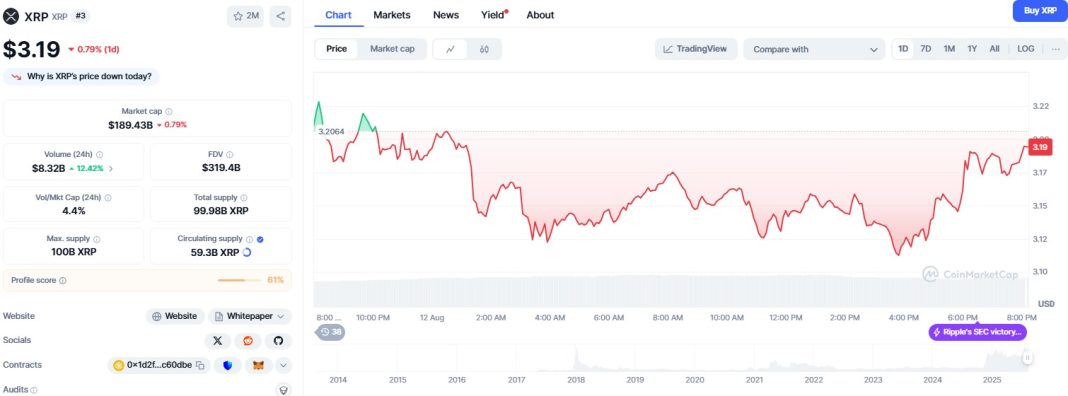

XRP has surged more than 550% since November, climbing above $3 on Tuesday, and sparking discussions in the crypto market about its next potential milestone.

Technical analyst Gert van Lagen has pointed to a long-term chart pattern suggesting the token could rise to $34 by mid-2026.

This projection is based on the completion of a multi-year double-bottom structure, a bullish pattern often followed by substantial price moves.

Historical precedents, recent legal developments, and strong ETF approval expectations are also influencing investor sentiment, although on-chain metrics point to valuation risks that could temper the rally.

XRP is now trading at $3.19, down by 0.79% in the past 24 hours.

Technical breakout points to a multi-year rally

According to Van Lagen, XRP has broken out of a seven-year double-bottom pattern after pushing above the neckline resistance near $1.80.

The breakout was followed by a retest of the neckline, which acted as support.

In technical analysis, such a retest is often interpreted as confirmation of a strong breakout.

Using a 2.00 Fibonacci extension, the measured-move projection from this setup points to a target of $34 by mid-2026.

This setup resembles XRP’s 2014–2017 price action, when a similar long-term base led to a parabolic rally of over 100,000%.

XRP’s markets have seen multiple instances of large gains, including a 1,072% rise from the 2022 lows and a 1,625% surge during the 2020–2021 cycle.

Market drivers boosting XRP’s rally

The 2020–21 rally coincided with near-zero interest rates in the US, while the current gains have been driven by developments in the Ripple lawsuit, improved legal clarity, exchange relistings, and optimism for a spot XRP exchange-traded fund (ETF).

In 2025, market sentiment has been particularly influenced by forecasts indicating a 95% probability of spot ETF approval.

Analysts suggest that if an approval comes through, XRP could climb toward $27, bringing it close to Van Lagen’s target.

The ETF narrative has helped maintain bullish momentum this year, with traders factoring in the potential influx of institutional capital.

In past cycles, major inflows often occurred when regulatory milestones were reached, creating strong short-term surges.

Onchain metrics signal overvaluation risks

Despite the strong rally, onchain data highlights concerns.

XRP Ledger (XRPL), the blockchain underpinning XRP, shows much lower activity levels than other major layer 1 blockchains, including Ethereum.

Data from DefiLlama indicates that while XRP has a market capitalisation of $190 billion, its total value locked (TVL) stands at just $85 million — a ratio of about 2,200.

By comparison, Ethereum’s ratio is around 5.6, even though XRP’s market value is nearly 40% of Ethereum’s.

Another potential challenge is that over 95% of XRP’s circulating supply is currently in profit, according to Glassnode.

Historical data shows that in previous rallies, such a level of profitability often preceded significant price corrections, as profit-taking intensified and selling pressure mounted.

This trend was observed during the 2020–21 and 2022–25 cycles, when similar conditions led to pullbacks.

While technical patterns and market drivers are currently supporting XRP’s bullish case, the imbalance between valuation and onchain activity, coupled with elevated profit-taking potential, suggests that sustaining a rally toward $30 and beyond may face strong resistance.

The post XRP price up over 550% since November, technical setup suggests possible rally toward $34 appeared first on CoinJournal.