- Ripple CTO posts Monty Python GIF after settlement.

- XRP case centred on security classification.

- Traders adopt the “buy the rumour, sell the news” approach.

Ripple’s legal battle with the US Securities and Exchange Commission (SEC) concluded last week, ending years of uncertainty over whether XRP should be classified as a security.

The outcome was expected to boost investor confidence, but XRP has instead fallen 4% today, underperforming most other major altcoins.

The unexpected drop has prompted questions about market behaviour and the impact of regulatory developments on token prices.

While the SEC now signals a shift towards developing clearer cryptocurrency rules, market reaction suggests traders may be waiting to see how these proposals translate into policy before making long-term commitments.

Ripple CTO uses Monty Python clip to mark SEC case end

Following the settlement, Ripple’s chief technology officer, David Schwartz, marked the moment with a Monty Python reference on X.

Posting a GIF from the “Salad Days” sketch, Schwartz chose a scene where a character cheerfully declares, “What a simply super day” before chaos unfolds.

The post came just days after the SEC wrapped up the prolonged case against Ripple, a lawsuit that had shaped much of the discussion around crypto regulation in the United States.

The dispute focused on whether XRP constituted a security under federal law.

Its resolution was widely expected to remove a significant source of uncertainty for Ripple and its investors.

SEC officials signal policy shift after Ripple settlement

With the case closed, SEC Chair Paul Atkins and Commissioner Hester Peirce stated they intend to work towards “clear rules of the road” for digital assets.

Ripple’s chief legal officer, Stuart Alderoty, acknowledged the development on X, expressing support for a move towards regulatory clarity.

This represents a notable change in the SEC’s tone, moving from enforcement-driven actions to signalling interest in proactive regulation.

Industry participants have long called for consistent guidelines, arguing that ambiguity in the current framework hinders innovation and deters institutional investment.

Price reaction reflects profit-taking and caution

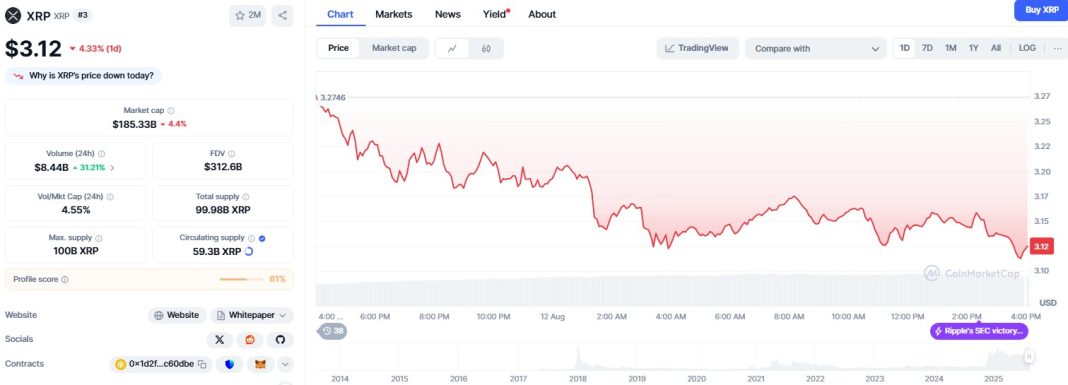

Despite expectations of a sustained rally, XRP’s price trajectory has moved in the opposite direction.

The token surged in the immediate aftermath of the legal outcome, but gains were short-lived.

Traders appear to have adopted a “buy the rumour, sell the news” approach, a common pattern in cryptocurrency markets where prices rise in anticipation of a positive event and then fall as investors lock in profits.

The current decline also suggests some market participants may be cautious, preferring to assess the SEC’s forthcoming regulatory proposals before re-entering or increasing exposure to XRP.

Questions raised on X by traders highlight the puzzlement over the drop, given the removal of legal uncertainty that had weighed on the asset for years.

The combination of profit-taking, short-term sentiment, and anticipation of regulatory details appears to be driving the subdued market response.

Until further policy clarity emerges, XRP’s price may remain influenced by both macro-level regulation news and speculative trading behaviour.

The post Why XRP price has failed to breakout despite SEC settlement appeared first on CoinJournal.